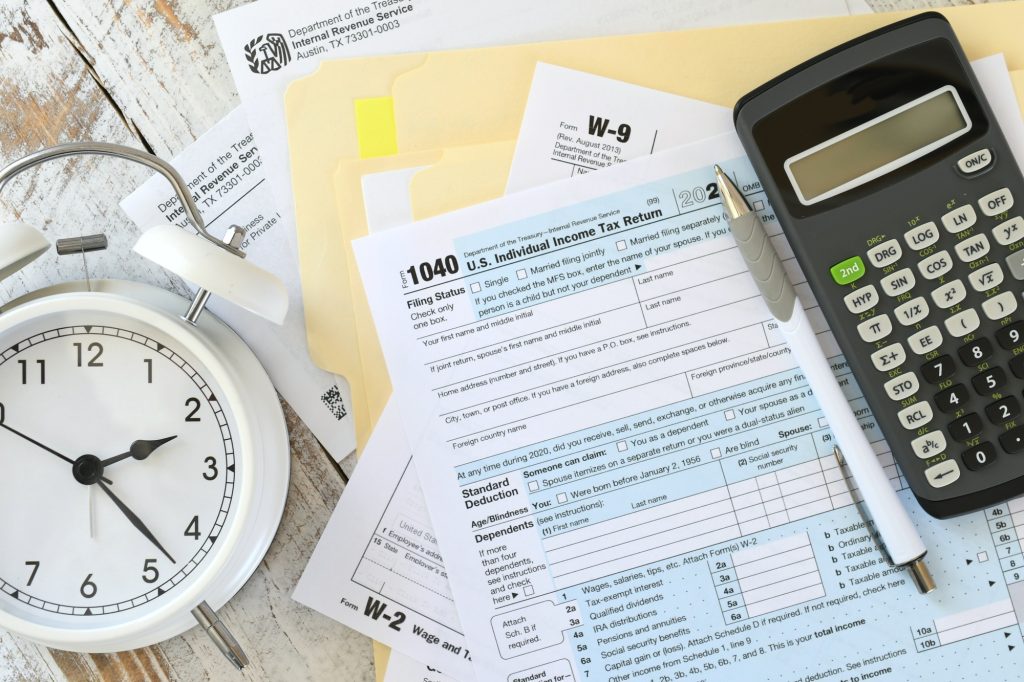

Tax Preparation

With years of experience and a commitment to excellence, we take the complexity out of tax preparation, giving you peace of mind and potentially saving you money.

Service Details

Tax Preparation Services inWest Palm Beach

Tax season doesn't have to be stressful. At Niko Bookkeeping, we provide expert tax preparation services in West Palm Beach for individuals and businesses of all sizes. Whether you're a single owner, managing an LLC, or operating an S-Corp or C-Corp, our team ensures accurate filing, maximum deductions, and full compliance with tax regulations.

Our Tax Preparation Services

1. Personal Tax Preparation

We help individuals navigate the complexities of personal tax returns, ensuring accuracy and maximizing deductions.

- Individual Tax Returns

- Joint Filing for Couples

- Itemized Deductions

- Tax Credits Identification

2. Business Tax Preparation

Our comprehensive business tax services cater to various business structures, including:

- Single Owner/Sole Proprietor Returns

- LLC Tax Filings

- S-Corporation Tax Preparation

- C-Corporation Tax Services

3. LLC Formation and Management

Beyond tax preparation, we assist with:

- LLC Setup and Registration

- Ongoing Tax Compliance

- Annual Filing Requirements

- Tax Strategy for LLCs

4. Tax Planning and Strategy

We don’t just prepare taxes—we help you plan for them:

- Year-Round Tax Planning

- Quarterly Estimated Payments

- Tax-Saving Strategies

- Future Tax Liability Projections

Why Choose Niko Bookkeeping for Tax Preparation?

Expertise Across Business Structures

We understand the tax implications for different business entities, from sole proprietorships to corporations.Maximized Deductions

Our team identifies all eligible deductions and credits to minimize your tax liability legally.Accuracy and Compliance

We ensure your tax returns are accurate and compliant with all federal, state, and local regulations.Year-Round Support

Tax preparation isn’t just a seasonal service for us—we provide support throughout the year.

Who Can Benefit from Our Tax Preparation Services?

- Individuals seeking accurate personal tax returns and maximum refunds

- Small Business Owners needing assistance with business tax filings

- LLC Owners requiring specialized tax preparation and planning

- S-Corps and C-Corps looking for comprehensive corporate tax services

- Self-Employed Professionals navigating self-employment taxes

What Client Say About Services

Read what our satisfied clients have to say about trusting Niko Bookkeeping for their financial and business needs.

- Comprehensive Solutions:

- Personalized Support

- Expert Guidance

- Local Expertise

EXCELLENTTrustindex verifies that the original source of the review is Google. Niko has been doing my taxes for over 14 years. He’s thorough, always asks multiple questions, and promptly completes my taxes, always with the goal of getting me the highest refund. I highly recommend him!Trustindex verifies that the original source of the review is Google. Una excelente persona amable y muy eficaz en lo que hace se los recomiendo ampliamenteTrustindex verifies that the original source of the review is Google. Niko is great! We’ve used him for 3 years in a row now for our annual taxes. He is extremely detailed, timely, and very easy to work with! He does everything he can to maximize your deduction and refund. Responds quickly. We’ll continue to use him for years to come!Trustindex verifies that the original source of the review is Google. I’ve been working with my tax preparer, Niko, for nine years, and he’s been outstanding. Not only has he handled my taxes, but he’s also taken care of my entire family’s taxes with the same level of care and expertise. I have been doing my taxes in FL for the past 7 years then moved to GA and he still does my taxes! I don’t trust anyone else but him. He’s incredibly knowledgeable, always up to date on tax laws, and makes everything easy to understand. When I went through an audit, Niko guided me through the process with ease and made it stress-free. He speaks both Spanish and English, which has been a huge help for our family. Whether my taxes are simple or complicated, I always feel confident everything is handled correctly. He’s professional, truly cares about his clients, and offers invaluable advice. I would refer him to anyone without hesitation! PS. He gets you the most of your tax refund the legal way :)Trustindex verifies that the original source of the review is Google. He is the best accountant! Thank you for your help. Nobody helped us as he did. The accountant we had before was awful and Niko completely changed that situation for us. We will totally count with him always!Trustindex verifies that the original source of the review is Google. Great customer service and peofessional. This is my first time going with Niko and he was very helpful and answered all of my questions. Niko was highly recommended and I highly recommend him as well.Trustindex verifies that the original source of the review is Google. Excelente servicio. Super recomendadoTrustindex verifies that the original source of the review is Google. Niko es el mejor 🙏🌟 2 años trabajando con el y siempre muy efectivo

Frequently Asked Questions

Professional tax preparation ensures you claim all eligible deductions and credits while avoiding costly errors. Our experts stay current with tax law changes to maximize your savings legally.

LLCs typically use pass-through taxation where profits pass to personal returns, while S-Corps require separate corporate returns and can offer self-employment tax advantages. We help determine the most beneficial approach for your situation.

Yes, we specialize in multi-state tax returns for businesses and individuals who work or earn income in multiple states.

We use a comprehensive review process, checking all calculations, verifying documentation, and staying updated on tax code changes to ensure accuracy and compliance.

Absolutely! We offer year-round tax planning services to help you make strategic decisions that minimize your tax liability before tax season arrives.

Generally, you'll need income statements (W-2s, 1099s), expense records, investment information, and previous tax returns. We'll provide a detailed checklist based on your specific situation.

Ready for a Free Consultation?Call Us Now

Don't wait until tax season to get expert help. Contact Niko Bookkeeping today for professional Tax Preparation Services in West Palm Beach. Let us help you navigate the complexities of tax filing with confidence and ease.